By Balazs Koranyi

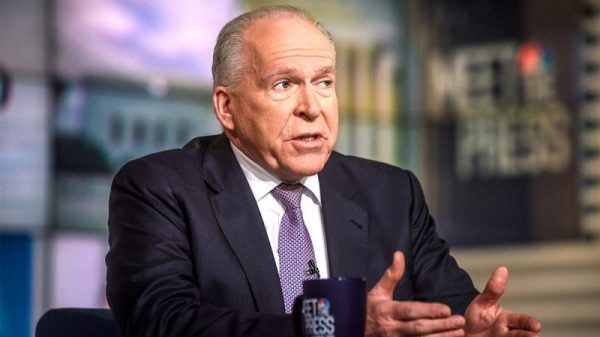

FRANKFURT (Reuters) – The European Central Bank should keep cutting interest rates by small increments and there is no need to ease policy to a level that starts stimulating economic growth, Cypriot policymaker Christodoulos Patsalides said on Thursday.

The ECB has been easing policy for much of this year and the debate is now about how fast and how far it should cut rates as inflation worries have largely evaporated and growth remains anaemic.

“I personally prefer small adjustments in a gradual process as opposed to bigger interest rate cuts,” Patsalides told Reuters.

“Given the elevated level of uncertainty in both directions, we need to be vigilant and careful,” Patsalides, one of the newest members of the ECB’s Governing Council, said. “We also don’t want to surprise the markets and give the wrong signals.”

Some policymakers, mostly from the 20-nation currency bloc’s south, argued last week for a 50 basis point rate cut but Patsalides said such a move would require inflation to fall below the ECB’s 2% target durably, which is not expected now.

“The inflation projection would have to show that inflation will remain well below the target for a very long time,” he said. “Other than that, I wouldn’t go for bigger cuts.”

“I don’t see inflation undershooting persisting for a very long time,” Patsalides, a PhD economist with both commercial and central banking experience, said.

NEUTRAL RATE

Patsalides said that interest rates would follow a downward path but he decline to endorse market pricing for four straight cuts in the first half of 2025 because markets sometimes get it wrong and reserved the right to change his mind in case the outlook shifted.

The ECB also had no reason to lower interest rates to a level that starts to stimulate the economy, Patsalides said, weighing in on another key debate on whether the ailing economy would once again need a boost from its central bank.

“Going below the neutral rate would imply that we are undergoing a recession or that a severe recession is projected,” he said. “But this is not what the ECB projections show. Right now I don’t see a situation in which rates would go below the neutral rate.”

The neutral rate, which neither stimulates nor slows growth, is a loosely defined concept and estimates lie in a wide range.

Patsalides, using one of the wider estimates, said it was between 1.5% and 3%, so the ECB was approaching it after it cuts its deposit rate to 3% last week and it was not necessarily the case it had some distance to get there.

“I think we will know where the neutral rate is when we are there,” Patsalides said. “It’s difficult to pursue policies on the basis of a preconceived neutral rate.”

Markets now see the ECB’s 3% deposit rate falling to 2% by mid-2025 and also see a 50% chance it would fall further, to 1.75% by year-end.

One worry for some has been the dollar’s recent strength, which could continue if the new U.S. administration imposes trade barriers but this is not an issue for euro zone inflation, Patsalides said.

“I don’t have a view on the appropriate exchange rate but the current level does not appear to be creating any inflationary issues,” he said.

Tariffs imposed by incoming U.S. President Donald Trump could be inflationary in the near term but they weigh on growth, so the longer term impact could be mixed and will depend on the specific composition of measures.