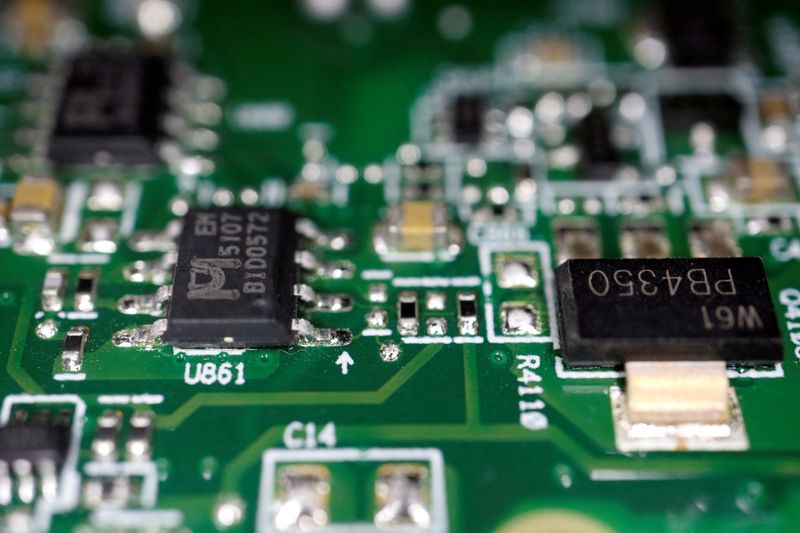

BEIJING (Reuters) -China will launch an investigation into U.S. government subsidies to its semiconductor sector at the request of China’s mature node chip industry, the commerce ministry said on Thursday.

Unlike the cutting-edge chips used to power artificial intelligence, mature node chips are larger and used for less complex tasks, including home appliances and communications systems.

“The Biden administration has given a large amount of subsidies to the chip industry, and U.S. enterprises have thus gained an unfair competitive advantage and exported relevant mature node chip products to China at low prices, which has undermined the legitimate rights and interests of China’s domestic industry,” China’s commerce ministry said in a statement.

The U.S. Department of Commerce did not respond to a request for comment on the Chinese investigation.

Beijing’s accusation echoes the Biden administration’s reasoning for announcing a tariff hike on all Chinese chip imports in September, and a probe into China’s mature chip node industry last month, which U.S. Trade Representative Katherine Tai said had expanded capacity, artificially lowered prices and hurt competition using Chinese state funds.

While it is unclear what retaliatory action will come out of the Chinese government’s probe, U.S. firms such as Intel (NASDAQ:INTC) that derive a large portion of their revenue from selling mature node chips to the Chinese market could be affected.

Washington has over the past 3 years tightened export controls targeting the sale of advanced U.S.-made AI chips to China.