The Blockchain Futurist Conference, one of several Web3 events held in Toronto during Canada’s fifth annual Crypto Week, dove into the industry’s potential and the regulatory gaps that might stall progress.

Across a slew of keynote panels and conversations, industry insiders kept coming back to a similar conclusion: Web3 is global by design, but regulation remains fragmented.

As global jurisdictions advance frameworks for stablecoins, decentralized finance (DeFi) and tokenized assets, Canada must choose whether to create new regulations, or adapt old policies that don’t fit an evolving financial landscape.

A deeper exploration of four key themes that emerged from the event reveals the nuanced perspectives and emerging trends shaping the next phase of Web3 innovation and adoption.

1. Digital assets need global regulation

Speakers on the “Future of Global Regulation� panel discussed the need for a collaborative global approach on regulation, stressing that a balance between innovation and consumer protection is key.

“There’s going to have to be collaboration,â€� Cody Carbone, CEO at the Digital Chamber, pointed out. “I mean, it’s technology that’s borderless, and you’re dealing with so many cross-border agencies.â€�

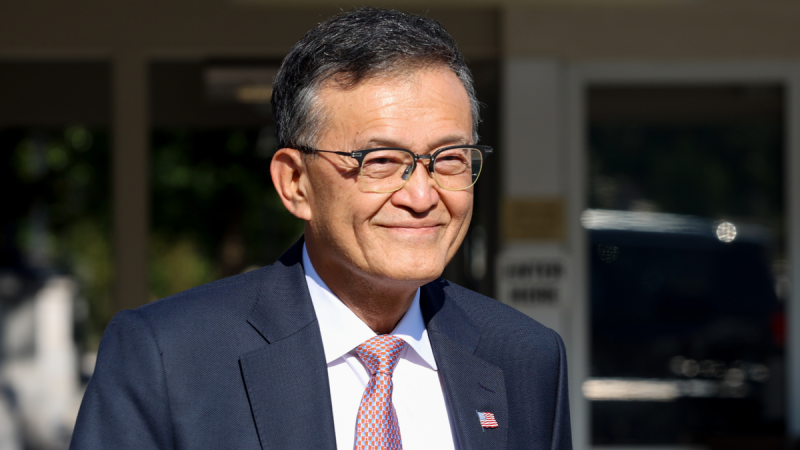

Anson Law, chief representative of the Hong Kong Monetary Authority, described Hong Kong’s principles-based approach to digital asset regulation, where the focus is on creating regulatory principles rather than strict controls.

Law said he expects to see international regulatory standards develop after increased discussions with organizations like the Financial Stability Board and the Organisation for Economic Co-operation and Development.

El Salvador was held up as a cautionary tale that pro-crypto policy is not enough for widespread usage — adoption depends not only on legal clarity, but also on user confidence and adequate infrastructure. Public engagement is essential to raising awareness about how blockchain technology can be applied, which will encourage wider use.

Ultimately, global leaders are beginning to understand the importance of staying up to date with blockchain innovation. International collaboration will be critical to avoiding a fractured ecosystem.

2. Canada at a regulatory crossroads

Stablecoins already represent 70 percent of global crypto trading volume — yet Canada lacks a widely used, domestic digital currency. That was the message from Coinbase Global’s (NASDAQ:COIN) Lucas Matheson at a fireside chat with Alex McDougall, president of Stablecorp, the company behind QCAD, a Canadian-dollar backed stablecoin.

The urgency of regulatory modernization underscored their conversation, and that sentiment was also present when Coinbase Ventures and other investors announced a US$1.8 million investment in Stablecorp to enhance QCAD’s features and digital infrastructure in order to expand its role in payments, FX and digital asset transactions.

McDougall noted that Canada processes over US$400 billion in daily FX trades, making stablecoins a logical evolution; however, without modern, federal regulation, QCAD’s growth could be stifled before it begins.

Once hailed as an early mover in crypto regulation, Canada is now facing increasing criticism for falling behind.

At the “Canadian Web3 Regulation� panel, Suzanne Lasrado of the Canadian Investment Regulatory Organization (CIRO) acknowledged that the rules in place don’t fully accommodate crypto’s needs. Unlike most other jurisdictions, which classify stablecoins as payment instruments, CIRO currently oversees stablecoins as securities.

Lasrado said the organization is working to evolve the current system, which relies on a patchwork of legacy approaches. Her fellow speakers on the panel echoed Matheson and McDougall’s warning that this regulatory disconnect risks marginalizing Canada’s place in the fast-moving global stablecoin race.

Industry leaders were more direct. Mark Greenberg of crypto trading platform Kraken Digital Asset Exchange said his company’s substantial investment in regulatory compliance in Canada has ultimately paid off, but expressed concern that the country’s risk-averse stance could stifle innovation and growth.

“A lot of the pieces that we pioneered here in Canada are now used in many markets in the world. They’ve been transported to Europe and the UK, and so that was a good investment for us,â€� he explained.

“At the same time, we’re not going to be launching any of the new, interesting things we’re working on in Canada, and the reason behind that is I do not know how to bring them into this market. I don’t have the same kind of flexibility that I do with the regulators in the US, or in Europe, or in Bermuda, or the British Virgin Islands or other markets where we operate, and that’s something that has to change,’ Greenberg told conference attendees.

NDAX COO Tanim Rasul highlighted that Canada’s reactive regulatory culture, shaped by scandals like Quadriga, tends to prioritize restriction over innovation. Meanwhile, Mo Yang of Convoy Finance called for a more nuanced approach to DeFi, one that differentiates between retail and institutional players.

For Matheson and McDougall, QCAD serves as a hopeful case study. With coordinated policy and private sector innovation, stablecoins could become a central pillar of Canadian fintech.

3. Tokenization as an investment paradigm

Beyond regulation, another major theme of the Blockchain Futurist Conference was tokenization.

The “Why Tokenize?� panel featured industry practitioners and innovators who made the case that tokenization could democratize access to everything from real estate and mining to private credit and collectibles.

“Asset ownership, for the longest time, has been limited to a select group of investors and institutions. With tokenization, it enables fractional ownership and efficiency, which allows us to expand liquidity beyond certain geographies,� explained Bilal Hammoud, CEO of Canadian cryptocurrency exchange NDAX.

Hunter Milborne, CEO of Milborne Group, a Canadian real estate development company, drew comparisons to the rise of condominiums, which opened up ownership in ways traditional real estate hadn’t.

“I can see a big parallel today. Now you have accredited investors, you’ve got all these regulations, you need $100,000 or $250,000 to invest in something … this is something that can be available at a much lower number to people who can share in the asset base,â€� he explained to moderator Natalie Hirsch, CFO at Polymath Network.

“There’s a saying in our business that you can’t out-save real estate. You buy the right piece of real estate, and it goes up in value a little bit each year,â€� he continued. “But for somebody who has $1,000 or $5,000 or $500 or $10,000, it’s just not available. So I think that it’s going to broaden that market base. And there (are) statistics that estimate that between now and 2035, you’re going to have a $4 trillion industry growing at almost 30 percent a year.â€�

Kirill Soloviev, CEO of KS Group, emphasized that tokenization could broaden access to mining, another traditionally capital-intensive sector. Through fractionalized digital ownership, people could participate in projects at various stages without needing to provide millions in capital upfront.

“It gives us a full cycle, not only to raise the money that initially we need, but also sell it to the end user,� he said, before Hirsch teased a potential future deal announcement between KS Group and Polymath.

4. Finance has a decentralized future

Finally, finance reporter Claire Brown moderated a panel discussing the potential for DeFi to replace traditional finance (TradFi). Wesley Crook, CEO of FP Block, highlighted 24/7 settlement and transparency as distinct advantages that DeFi has over traditional finance, while BitGo’s Chen Fang noted DeFi’s lower barriers to entry.

“Anybody on Earth with an internet connection can download any number of these wallets and, with a couple of clicks, get into any number of markets that exist within various blockchains. It’s that simple,â€� he said.

However, EY’s global blockchain leader, Paul Brody, noted the advantages traditional financial institutions still have over DeFi, specifically their ability to analyze extensive personal data for nuanced risk assessment.

“They can make bets on participants that DeFi ecosystems cannot do, so they have that advantage. For how long, I’m not sure, but at the moment, it’s very clearly their play,â€� he clarified.

On the other hand, Mike Silagadze, founder and CEO of ether.fi, argued that TradFi’s perceived advantage isn’t due to superior innovation or efficiency, but is instead a result of its highly concentrated and anti-competitive nature, something DeFi aims to dismantle by offering more transparent, accessible and potentially lower-cost alternatives.

Fang believes the core technology behind DeFi has matured significantly, from speculation to “very realâ€� use cases like remittances. “It’s time to replace those systems, in my opinion, with some of the technologies that we’ve built within this industry,â€� he said. He expects the underlying technology to be applied to multiple new use cases in the next 10 years.

As a caveat, Crook emphasized that trust must be established, and user design needs to be simplified for mainstream adoption to truly take hold. “We have to build systems that will allow trust to be put into the space. We’ve got to simplify. We have way too much of a complicated environment to play in. If we can’t get grandma and grandpa onto these systems with a push of a button on their phone, we’re going nowhere,â€� he said.

The panel concluded with optimism about DeFi’s potential to transform financial services, including the potential emergence of ‘DeFi banks’ that could expand the DeFi market significantly.

Investor takeaway

The speakers at this year’s Blockchain Futurist Conference made one point clear: Web3 innovation is accelerating, but without aligned regulation, its full potential can’t be realized.

Countries like the US and Hong Kong are writing rules that welcome digital assets into the mainstream. Canada, once a frontrunner, must now decide how to adapt. While the tools and technologies for a decentralized future of finance are maturing and hold promise for a more accessible and efficient financial landscape, these advancements require clear rules and user-friendly interfaces to achieve widespread adoption.

Securities Disclosure: I, Meagen Seatter, hold no direct investment interest in any company mentioned in this article.