The post Crypto Market Today [Live] Updates On October 30 appeared first on Coinpedia Fintech News

October 30, 2025 05:52:16 UTC

Whales Go Long: Massive Leveraged Bets Signal Bullish Confidence on Hyperliquid

Despite the broader market downturn, major crypto whales are showing strong bullish conviction on Hyperliquid. Trader 0x9553 entered his first position with a 40x long on 179.59 BTC ($19.94M), while a new wallet 0x6988 deposited $1.95M USDC to open a 25x long on 4,743 ETH ($18.71M). Meanwhile, 0xd260, boasting an 83.72% win rate and over $2.6M in profits, has now opened a 40x long on 62 BTC ($6.88M). These aggressive positions hint that whales are positioning for a strong market rebound.

October 30, 2025 05:50:58 UTC

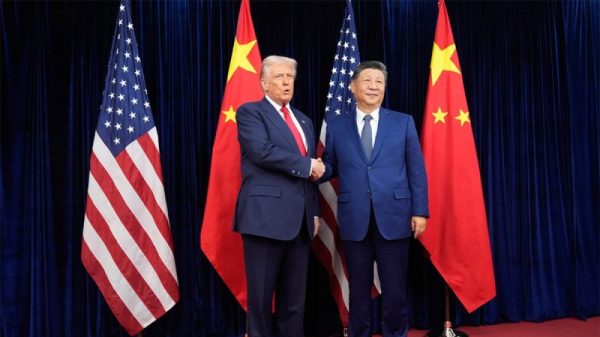

Trump and Xi Signal Breakthrough: Tariff Cuts Hint at Major US-China Trade Deal Ahead

President Trump announced significant tariff reductions following what he called an “amazing” meeting with President Xi. The U.S. has cut Fentanyl tariffs to 10% effective immediately, and overall tariffs on China have been reduced from 57% to 47%. China has also agreed to discuss chip restrictions with Nvidia, lift obstacles on rare earth exports, and collaborate with the U.S. on Ukraine. The tone marks a clear thaw in relations — and with these moves, a potential US-China trade deal now looks closer than ever.

October 30, 2025 05:47:39 UTC

Fed Ends QT, Signals Liquidity Surge

The Fed’s 25 bps rate cut came as no surprise, but the real story lies in its decision to end Quantitative Tightening (QT) on December 1. While Miran’s call for a 50 bps cut signals Trump’s push for deeper easing, the end of QT marks a major policy shift after months of speculation about renewed liquidity. With fresh capital expected to flow back into the system, dovish momentum is building fast — creating an extremely bullish setup for risk assets, especially crypto, as investors brace for a liquidity-fueled rally.

October 30, 2025 05:40:57 UTC

Bitcoin Trapped Between Key Levels: Watching $115.2K Breakout Zone

Bitcoin (BTC) remains range-bound, caught between two critical technical levels. The immediate resistance sits at $115.2K, a long-held level that continues to cap upward momentum, while support lies near $111.3K, the H4 breakdown and consolidation zone.Analysts note that a 4-hour close above $115.2K could signal a potential breakout, opening the door for renewed bullish momentum. Until then, Bitcoin’s price action remains confined within this tight trading range as traders await confirmation of the next directional move.