By Saqib Iqbal Ahmed and Laura Matthews

NEW YORK (Reuters) – Growing risks to the U.S. stock rally are spurring demand for portfolio hedging, options markets showed, as investors grapple with U.S. economic uncertainty, shifting Federal Reserve policy and a looming presidential election.

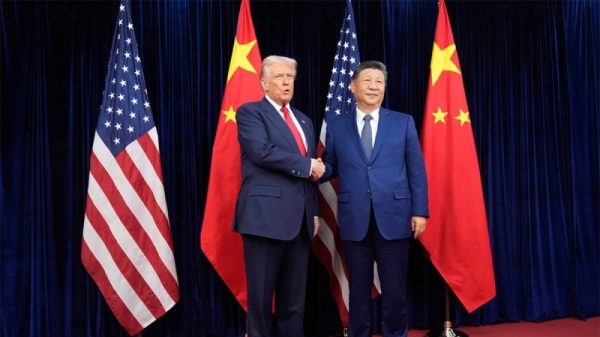

As the spotlight turns toward Tuesday’s high-stakes televised debate between Democrat Kamala Harris and Republican Donald Trump, the Cboe Volatility Index is hovering around 20. That compares with a 2024 average of 14.8 for the index, which measures demand for protection against stock swings.

The VIX typically rises around 25% between July and November in election years, as investors sharpen their focus on the market implications of candidates’ policy proposals, BofA data showed.

This year, however, political concerns have coalesced with more pressing catalysts for volatility, such as worries over a potentially softening U.S. economy and uncertainty over how deeply the Fed will need to cut interest rates, investors said. The S&P 500 notched its worst weekly percentage loss since March 2023 last week after a second-straight underwhelming jobs report, though the index is still up nearly 15% this year.

“This is an uncertain market,” said Matt Thompson, co-portfolio manager at Little Harbor Advisors. “The market is essentially saying, we know risk is elevated, but … we don’t know what the problem is going to be.”

With volatility already elevated, the “election bump” in October VIX futures, which also encompass the Nov. 5 vote, is far smaller than in previous years. On Tuesday they traded at 19.55, less than 1 point above the September contracts. Moreover, the gap between the contracts with the highest and lowest volatilities is barely above 1 volatility point.

In the 2020 and 2016 election cycles, the futures curve presented a 7.3 and 3.4 point gap, respectively, between the months with the highest and lowest volatility, a Reuters analysis of LSEG data showed.

SPEED BUMPS AHEAD?

The VIX has been in sharper-than-usual focus for investors in recent weeks after the index posted its largest ever one-day spike on Aug. 5, during a sharp market sell-off spurred by economic worries and an unwinding of the global yen carry trade.

Though volatility took only days to subside, the index has crept up again as markets have grown choppy again in recent days. Societe Generale (OTC:SCGLY) analysts advised investors on Monday to stay hedged for the next three to six months, warning of possible volatility from unpleasant economic surprises and geopolitical factors such as U.S. elections and conflict in the Middle East and Ukraine.

Others, however, see reasons why investors are less nervous about election risks this time around.

Stocks have done well under both Trump and President Joe Biden, noted Seth Hickle, managing partner at Mindset Wealth Management. With Harris’ policies seen as sticking close to Biden’s, either candidate’s victory does not present a major challenge to investors.

“We don’t really have a whole lot of uncertainty when it comes to what’s going to change. I don’t think it really spooks the market because we have already been through it,” Hickle said.

Still, Tuesday’s debate has the potential to jolt markets.

“Since the last presidential debate literally ended in a brand-new Democratic candidate, I do expect this to be somewhat volatility generating,” Amy Wu Silverman, head of derivatives strategy at RBC Capital Markets, said in a note.