By Marco Aquino

LIMA (Reuters) – Peru’s central bank expects that the Andean nation’s economy will grow 3.1% this year and a further 3.0% in 2025, it said in a report on Friday, maintaining expectations for a rebound after gross domestic product (GDP) contracted by 0.6% last year.

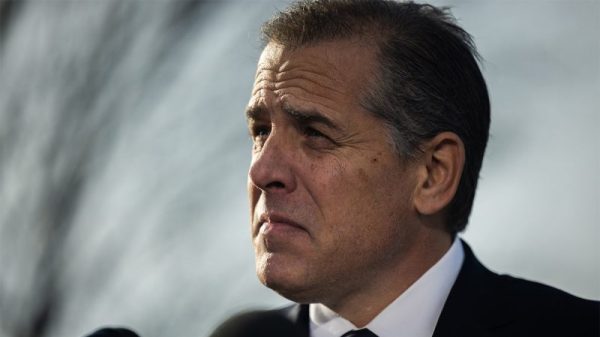

Central bank chief Julio Velarde said in a presentation that the 3.1% growth expectation was “probably biased to the upside.”

The bank raised its fiscal deficit forecasts to 3.3% of GDP this year, from a prior estimate of 2.8%, and to 2.0% next year from a previous forecast of 1.6%, which Velarde attributed to less revenue and more public investment.

Peru has this year set a rule not to exceed a deficit of 2.8% of GDP.

Velarde pointed notably to government support for struggling state oil firm Petroperu, which last week approved a further $1.75 billion in financing after its directors resigned.

Financial bailouts to Petroperu should this year be equivalent to 0.66% of GDP, he said.

The monetary authority also expects a $21.67 billion trade surplus this year, slightly under the previous estimate but which would nevertheless break a fresh record in spite of lower prices for copper amid lower demand prospects from China.

The bank also slightly increased its inflation forecast for this year to 2.3% from an earlier estimate of 2.2%. This however remains firmly within the target range of the central bank, which last week cut its benchmark rate by 25 basis points to 5.25%.

The government, meanwhile, has predicted the economy will grow 3.2% this year and 3.1% in 2025.

In July, the economy grew nearly 4.5%, the fourth consecutive month of growth, continuing a recovery from adverse climate and anti-government protests that slowed the country’s key mining industry last year.

The South American country, a major world supplier of copper, is currently battling extensive forest fires that have burned through crop lands and hit some archaeological zones.