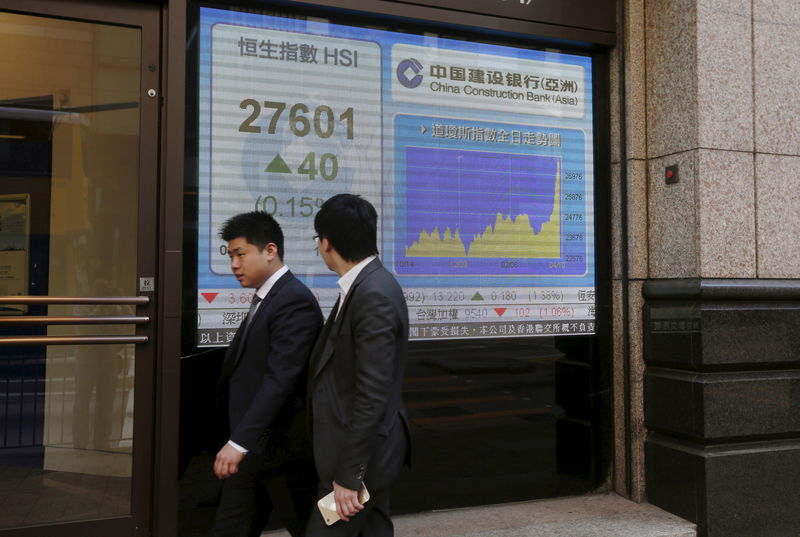

Investing.com — Morgan Stanley has adjusted its sector allocations in China following a recent market rally, reflecting a cautious stance amidst evolving economic policies and geopolitical uncertainties.

The brokerage has downgraded the consumer discretionary sector, while upgrading healthcare, signaling a shift towards defensive investments amid concerns about limited fiscal support and macroeconomic challenges.

The consumer discretionary sector has been moved to “underweight” from an “equal-weight” status, as the lack of detailed consumption-oriented stimulus measures raises doubts about near-term growth prospects.

In contrast, the healthcare sector was upgraded to “equal-weight” from “underweight.” This revision reflects a focus on cash-generating assets and resilience, considering the uncertainties surrounding China’s economic policy trajectory and global trade dynamics.

The reshuffling includes updates to Morgan Stanley’s focus list. The analysts have replaced Anta Sports, a prominent player in consumer discretionary, with Cosco Shipping Energy Transportation, citing stronger fundamentals and potential gains from global oil shipping demand.

In healthcare, China Resources Sanjiu was added to both the China/HK and A-share thematic lists. Known for its over-the-counter drug portfolio, Sanjiu is positioned to benefit from stable earnings, dividend payouts, and China’s state-owned enterprise reforms​.

Morgan Stanley’s outlook reflects a broader effort to align with more stable returns as fiscal policy remains gradual and geopolitical tensions linger.

Analysts have expressed caution about the potential impact of US trade policies and elections, which could disrupt specific sectors in China, further justifying the pivot towards healthcare and other defensive investments.

The note mentions that uncertainties remain high, with China’s fiscal expansion anticipated to proceed incrementally.

Morgan Stanley’s economics team projects additional fiscal stimulus worth approximately RMB 2 trillion for the remainder of 2024, followed by another RMB 2–3 trillion in debt swaps in 2025.

Against this backdrop, the focus on sectors less vulnerable to external shocks reflects a tactical shift aimed at navigating market volatility in the coming months.

This reallocation suggests Morgan Stanley’s preference for sectors offering cash flow certainty over speculative growth plays, marking a shift in its investment strategy amid the unpredictable economic environment.