By Libby George and Karin Strohecker

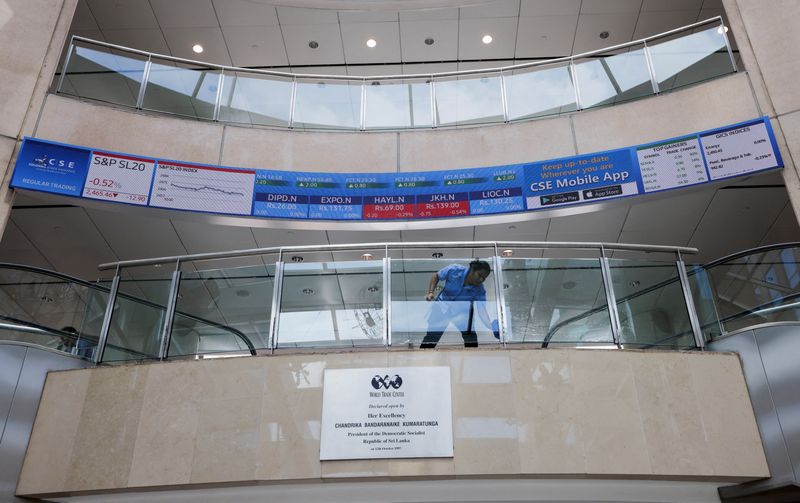

LONDON (Reuters) – Investors burned by Sri Lanka’s $12.5 billion debt default are using the subsequent years-long restructuring to try to force the island nation’s leaders to better manage the country.

Industry experts say the result is a first-of-its-kind bond linked to governance that will cut Sri Lanka’s debt costs if it improves transparency and financial management.

Bondholders resoundingly approved the debt restructuring package – including several types of new instruments – to replace the defaulted ones.

For Sri Lanka as well as its lenders there is much on the line.

“This crisis is first a governance crisis, and that’s what becomes an economic crisis,” said Nishan de Mel, executive director of Colombo-based Verité Research, the think tank that first proposed the governance bond.

“And if you don’t fix the foundation, you can build as much as you like, it will come crashing down again.”

‘ORIGINAL SIN’

Sri Lanka tumbled into a full-blown economic crisis in 2022, sparking its first-ever sovereign default. Fallout from COVID-19 and price spikes after Russia’s invasion of Ukraine dried up its foreign currency reserves, creating widespread shortages of food, fuel and medicines.

But bondholders like Kaan Nazli, a portfolio manager with Neuberger Berman, said poor governance – in the form of unsustainable tax cuts introduced in 2019 – was the “original sin” that pushed Sri Lanka over the edge.

“That made them very vulnerable to these shocks, and then eventually led to the default,” said Nazli, who was on the committee that negotiated the debt restructuring with government officials.

The crisis exposed billions in poor state spending. President Gotabaya Rajapaksa resigned in 2022 and the Supreme Court later ruled that his conduct contributed to the economic crisis.

The new bond would reward Sri Lanka with a 75 basis-point reduction in the interest rate if it proves it is managing the country’s economy effectively and transparently by meeting two targets.

It must exceed the International Monetary Fund’s baseline expectation for revenue to GDP for 2026 and 2027, and it must publish a fiscal strategy for 2026 and 2027 with details on total government debt, as outlined under a newly passed law.

Securing revenue – ie, sufficiently taxing workers and companies to fund budgets – is a perennial problem in emerging markets that investors view as linked to governance; countries that provide little to their citizens struggle to justify taxes.

Likewise opaque fiscal conditions, including hidden government-backed debts, have pulled other nations into default.

If Colombo does not meet its targets, it won’t be penalized but its coupon rates would increase from an initial 3.6% to 9.25% by 2032, with no 75 bps reduction, meaning it would miss out on an $80 million reduction in its interest payments.

De Mel described it as a rare win-win.

“What bondholders realized is that if we can reduce the governance risk through this instrument, then our value of the bond goes up, because immediately Sri Lanka is perceived then as more likely to repay.”

TRAILBLAZING BUT RISKY

Those who worked on the deal are hailing it as a precedent-setting instrument that could be used elsewhere to lower bond costs in exchange for transparency or better debt management.

Governance has been at the forefront of investors’ minds following the recent wave of sovereign defaults. Debt reworks in Zambia and Ghana have included provisions that require regular government presentations on debt levels and fiscal management.

“ESG has become more of a prominent theme in investment analysis,” Nazli said, referring to environmental, social, and governance criteria.

“I have a feeling we will have various different contingent instruments and at some point the market will look to standardize these and put additional considerations into analysing the cash flows.”

Leland Goss, managing director and general counsel at trade body the International Capital Market Association, said that while the $80 million in savings the governance bond could bring to Sri Lanka was relatively small compared with the country’s overall debt pile, the structure could bring more wide-ranging change.

“If this works and people accept the restructuring and this goes into the market trading, people will follow and monitor this and they’ll be held accountable through the media and the market, which is kind of interesting,” Goss said.

But in the meantime some investors have baulked at the complex nature of the overall restructuring. In addition to the governance-linked bond, the restructuring creates six new instruments including four macro-linked bonds and a past-due interest bond.

Bond prices have shed as much as 3 cents since the start of the month, to bid at 64.3-65.6 cents on the dollar, which investors attributed to some holders selling before the restructuring deal went through to avoid having complex instruments on their books.

Whether governance-linked bonds become more popular, investors said, could hinge on how well Sri Lanka’s performs.

“Like any firsts, it’ll be tricky to price, it’ll be tricky to trade,” said Giulia Pellegrini, senior portfolio manager with Allianz (ETR:ALVG) Global Investors.

“There’s a risk that if it goes poorly for whatever reason, people may be put off from following this example,” she said. “But I think all it takes is building a pipeline of these things … those difficulties whither away.”