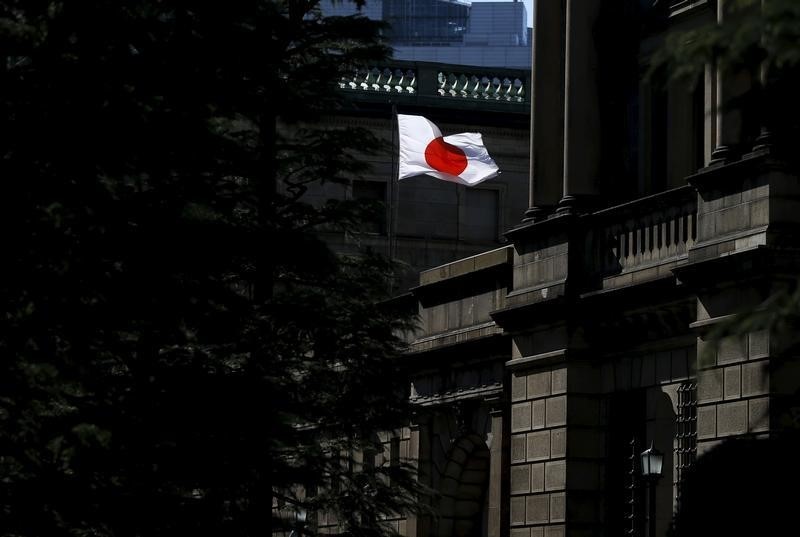

Investing.com– The Bank of Japan left interest rates unchanged as widely expected on Friday, and said that it continued to expect outsized growth in the Japanese economy amid a steady uptick in inflation.

The BOJ kept its benchmark short-term rate unchanged at 0.25%, with all nine members of the rate-setting board supporting a hold.

The decision was in line with market forecasts, with the BOJ expected to adopt a wait-and-see approach after raising interest rates twice so far this year.

The bank gave scant cues on plans to raise rates further in its monetary policy statement, with an address by Governor Kazuo Ueda, due at 02:30 ET (06:30 GMT) set to offer more cues on future rate action.

The BOJ said that it expects the Japanese economy to keep growing above consensus, and that inflation is also expected to increase in the coming months. Underlying consumer price index inflation is expected to increase gradually.

The BOJ’s decision comes just hours after CPI data for August showed inflation reaching a 10-month high, amid improving private consumption.

Higher inflation expectations have been a key driver of the BOJ’s rate increases this year, as the bank forecast an uptick in inflation and private spending on the back of higher wages. So far, inflation appears to be rising in line with the BOJ’s forecasts.

But the central bank still flagged “high uncertainties� over Japanese economic activity and prices, and said that volatility in foreign exchange markets was likely to affect local prices more than seen in the past.

The BOJ’s hold comes just days after the Federal Reserve cut interest rates and announced the start of an easing cycle.

The Japanese yen firmed after the BOJ decision, with the USDJPY pair falling 0.3% to 142.16 yen. Japanese stocks trimmed their intraday gains, with the Nikkei 225 trading up 1.9% after rising as much as 2.5% earlier in the session.