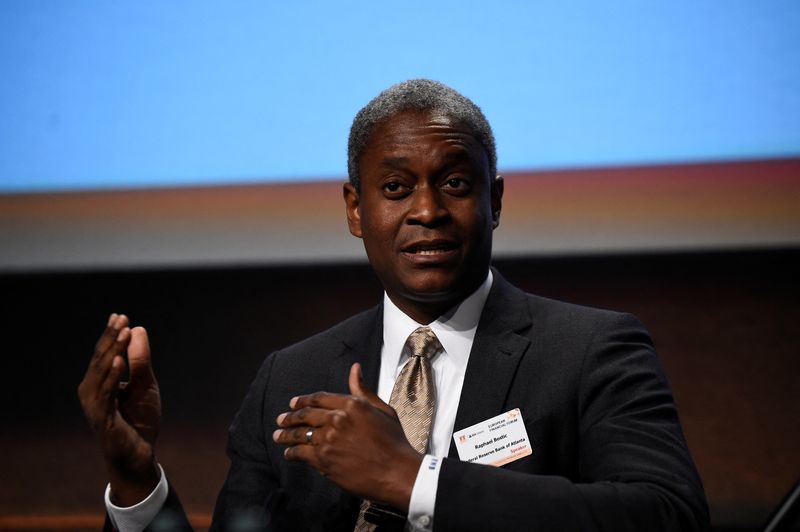

Investing.com — Atlanta Federal Reserve president Rapahel Bostic said Tuesday he expects the Fed to be more cautious on rate cuts as inflation is likely to continue its bumpy path toward target.

While Bostic expects inflation to gradually fall toward the 2% target, the Atalanta Fed president expects the move lower to be gradual accompanied by “bumpiness in the measures” that will likely call for a more cautious Fed.

“I think that will call for our policy approach to be more cautious—because we don’t want to overreact to any one data point in an environment where things may bounce around considerably,” Bostic added.

The Atlanta Fed chief, however, stressed that the Fed’s reaction mechanism will continue to be led by incoming data that could either prompt higher for longer rates, or a faster pace of rate cuts.

“I would want to make sure—for sure—that inflation gets to 2 percent, which means we may have to keep our policy rate higher longer than people might expect, or we may have to be more deliberate in the pacing of reducing our policy,” Bostic said.

The remarks come just weeks after the Fed delivered a hawkish cut at its December meeting as U.S. central bank’s outlook for further rate cuts were trimmed while inflation is expected to be stickier.

Data on Tuesday, meanwhile, stoked concerns about inflation after ISM services activity signaled signs of fresh price pressures.

The prices paid component in the ISM non-manufacturing survey rose to “the highest level since September 2023, and continued a 91-month streak of readings above 50,” Jefferies said in a Tuesday note. “This is not great news for the Fed achieving it’s inflation target, but it is consistent with a strong pace of activity in the sector overall,” it added.

Traders now expected the Fed to remain on holding until June, according to Investing.com’s Fed Rate Monitor Tool.