The US cannabis industry is at a turning point. State-level legalization and retail growth continue to accelerate, but federal policy remains stalled, leaving businesses navigating both opportunity and uncertainty.

Together, they shed light on the operational, financial and regulatory hurdles shaping the future of cannabis in the US.

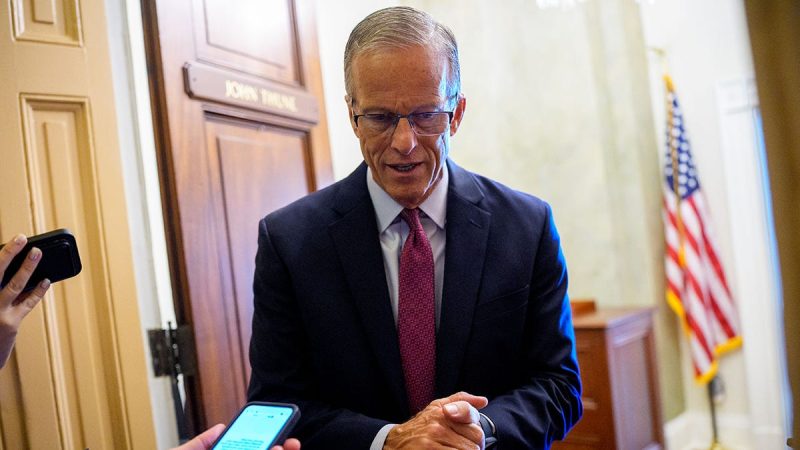

Banking reform stalled, but bipartisan momentum building

As the co-founder of Nabis — which works with more than 400 brands and thousands of retailers — Ning has a unique perspective on these challenges. He explained that forcing a multibillion-dollar, state-sanctioned industry to operate largely in cash comes with safety and economic risks for businesses.

“Bottom line, it costs us around 4 to 5 percent of our top line of the business, which is pretty substantial,� he said, citing expenses like armored vehicles, guards, security safes, theft insurance and cash processing fees.

The SAFER Banking Act is designed to create a safe harbor for financial institutions to provide these services, protecting them from federal penalties for working with state-legal cannabis businesses.

While the act did not pass during the Biden administration, it continues to receive support, with a bipartisan coalition of 32 state attorneys general renewing calls to pass the SAFER Banking Act during a congressional break in late July, underscoring its importance for public safety, economic transparency and financial access.

Analysts have noted the need for a creditworthiness benchmark for cannabis firms, saying that without one companies like Nabis have had to develop their own internal credit scoring systems.

The rescheduling debate: Tax relief and research

While banking reform would address operational security, federal rescheduling of cannabis would tackle the punitive tax burden under Section 280E of the Internal Revenue Code.

This past April, the US Drug Enforcement Administration (DEA) confirmed that its cannabis rescheduling review was still pending, with no new steps taken, subject to 90 day updates.

That same month, during an April 30 Senate hearing, new DEA head nominee Terrance Cole said reviewing the rescheduling proposal would be a top priority for him if confirmed, though he gave no position.

Several months later, in August, President Donald Trump said his administration was actively reviewing the proposal, with a decision expected in the coming weeks, though no hearing was scheduled. A day later, Representative Greg Steube (R-FL) reintroduced the 1-to-3 Act to legislatively move cannabis to Schedule III.

Also in late August, Representative Jerrold Nadler (D-NY) and other Democrats reintroduced the MORE Act to federally decriminalize cannabis, while Representative Morgan Griffith (R-VA) circulated draft legislation to regulate hemp-derived intoxicating products, closing Farm Bill loopholes. The STATES Act, which aims to allow states to set cannabis policies free from federal interference, was reintroduced in August as well.

Progress in rescheduling progress and the elimination of Section 280E would further mitigate banking risks, decrease business taxes and broaden opportunities for medical research.

Speaking about this topic, Ning provided a powerful financial metric. He estimates that the removal of the 280E tax would bring back roughly 12 percent to companies’ bottom lines. Ning described this as a non-dilutive gain that would make the cannabis industry a legitimate category for institutional investment.

“I think it would bring a lot of renewed sense of interest and excitement,’ he said.

Additionally, rescheduling would allow academic institutions to conduct more research with greater funding, as it would officially acknowledge cannabis as a medically accepted product with acceptable use cases.

Secretary of Health and Human Services Robert F. Kennedy has consistently shown interest in expanded research into therapeutic uses of cannabis and psychedelic compounds.

MAPS is conducting a Phase 2 study examining inhaled cannabis for the treatment of post-traumatic stress disorder in veterans, funded by a US$12.9 million grant from the Michigan Veteran Marijuana Research Grant Program.

Should legislative obstacles in Washington be overcome, America’s cannabis industry could see a new wave of opportunities. Unfortunately, a rescheduling decision is improbable before the midterm elections.

In September, Represenative Dina Titus (D-NV), co-chair of the Congressional Cannabis Caucus, told University of Nevada, Las Vegas, researchers that federal reform efforts remain stalled.

Shortly after, on September 11, the Department of Justice withdrew several proposed regulatory actions, including a measure to facilitate cannabis research and a hemp lab waiver tied to the rescheduling hearings.

Meanwhile, the House Appropriations Committee recently approved a bill blocking rescheduling or descheduling, but kept a rider protecting state medical programs.

State-level trends in US cannabis

Nabis’ unique position in the supply chain gives the company a macro view of the industry.

Data cited by Ning reveals that the cannabis industry as a whole is growing as more and more states legalize it; however, he noted significant differences between mature markets like California and newer ones. In mature markets, there are often more brands than retailers, giving retailers bargaining power to demand longer terms and deeper discounts, or sometimes not paying at all. Meanwhile, smaller brands have no other option but to sell to larger retail chains.

This imbalance is contributing to a trend of consolidation, which Ning said happens first in the most costly areas of the industry, such as distribution, followed by cultivation and then manufacturing.

Retailers are the most recent tier to see rapid consolidation.

While Ning believes this will eventually happen in younger markets like New York, where retail sales alone have already surpassed US$2 billion, he noted that the state’s regulations, which include credit laws and a limit on the number of licenses an individual can own, may prevent the kind of aggressive consolidation seen in California.

Ning also pointed to a shift in consumer behavior and product trends. While flower products remain the biggest base of the market, more highly manufactured products like edibles, concentrates and beverages are seeing significant growth in the legal market because consumers are more loyal to the brands that make them.

This is in contrast to the illicit market, where consumers tend to be loyal to the strain rather than the brand.

What’s next for US cannabis?

The cannabis industry is caught between growing state-level legalization and persistent federal uncertainty.

While some in the industry have lost hope in federal reform, Ning believes a new wave of investor confidence would emerge if either rescheduling or banking reform were to pass, or if there was a breakthrough in medical research.

In the meantime, Ning pointed out that the cannabis industry has historically been insulated from broader economic downturns because it operates domestically, and, in fact, is even more “hyper localized� within each state.

He also noted that cannabis, similar to other vices like alcohol or tobacco, tends to boom during recessions.

“We saw this during COVID. We saw this in prior situations that resembled depressive times before. So that brought back some investment sentiment as well,’ he concluded.

Securities Disclosure: I, Meagen Seatter, hold no direct investment interest in any company mentioned in this article.