By Ann Saphir

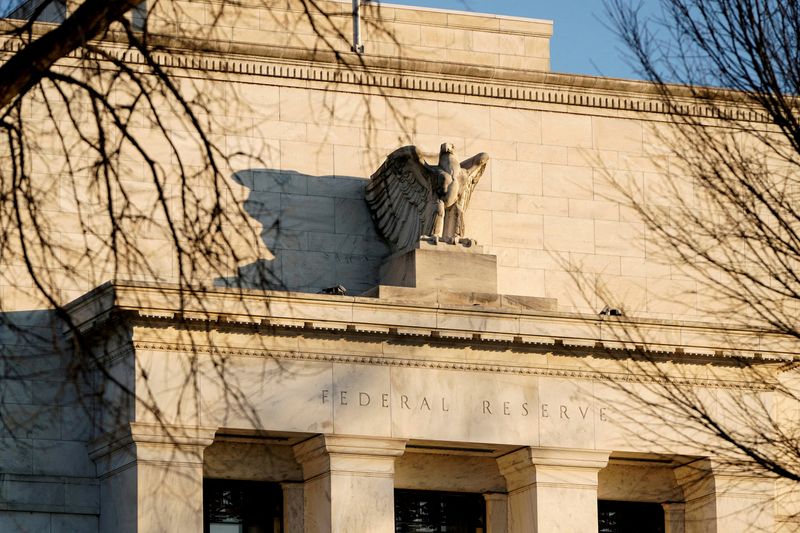

WASHINGTON (Reuters) – U.S. central bankers on Wednesday issued fresh projections calling for two quarter-point interest-rate cuts next year amid rising inflation, a forecast consistent with a wait-and-see approach come January as Donald Trump starts his second four-year stint in the White House.

The Federal Reserve’s latest quarterly summary of economic projections shows policymakers expect inflation by the Fed’s targeted metric to end this year at 2.4% and 2025 at 2.5%. It also shows policymakers see slightly stronger economic growth and lower unemployment next year than they had anticipated three months ago.

The fresh forecasts imply a shift to a far more cautious pace of rate cuts in the new year after Fed policymakers delivered a third straight reduction in short-term borrowing costs at the close of their Dec. 17-18 meeting. The majority indicated concern that inflation could reignite, which if borne out could be a recipe for keeping rates higher for longer.

The Fed’s target range for its short-term borrowing benchmark is now 4.25%-4.50%. The projections show policymakers see the benchmark lending rate ending 2025 in the 3.75%-4.00% range.

Analysts say that pace aligns with a likely pause in Fed action in January, if not for longer, as central bankers take stock of the economy and of the effect of any new policies put in place by the incoming president. Trump has promised to cut taxes, raise tariffs, and reduce regulation and immigration, all of which could have competing effects on the outlook for growth, employment and prices. Overall policymakers are now more uncertain about their inflation forecasts than three months ago, the projections show.

By the end of 2026, the policy rate will be another 50 basis points lower, at 3.4%, according to the median of policymaker projections, still above the median Fed policymaker’s revised 3% estimate of a neutral rate.

With Wednesday’s rate cut, the Fed has now cut rates a full percentage point this year as it telegraphed in September.

In September, the median U.S. central banker anticipated another full percentage point of rate cuts in 2025 and 50 basis points in 2026, with the easing motivated both by growing confidence that inflation was headed down and by worries that the labor market could deteriorate.

Since then, inflation has been unexpectedly firm, and the job market more robust than anticipated, though the latest readings suggest both continue to cool.

The projections, which represent individual policymakers’ views rather than an agreed consensus, show 10 of 19 policymakers coalescing around the 3.9% median view of the Fed policy rate by the end of next year, with four expecting a higher rate, and five expecting a lower rate.

FED PROJECTIONS

The economy is seen growing 2.5% this year and 2.1% in 2025, both upgrades to September policymaker forecasts for 2% for each of those years.

Unemployment, now at 4.2%, is projected to average 4.2% this quarter and 4.3% in the final quarter of 2025, versus the 4.4% previously expected for each.

Core personal consumption expenditures inflation, which strips out food and energy prices and which Fed policymakers use to gauge underlying price pressures, is seen staying high longer, reaching 2.8% this year and 2.5% at the end of 2025.

Policymakers had previously forecast core inflation to fall to 2.6% this year and 2.2% next year.