By Lisandra Paraguassu and Anthony Boadle

RIO DE JANEIRO (Reuters) – Leaders of the Group of 20 major economies were set to meet on Monday in Brazil for their annual summit, bracing for a shift in the global order with the return to power of U.S. president-elect Donald Trump.

Discussions of trade, climate change and international security will run up against sharp U.S. policy changes that Trump vows upon taking office in January, from tariffs to the promise of a negotiated solution to the war in Ukraine.

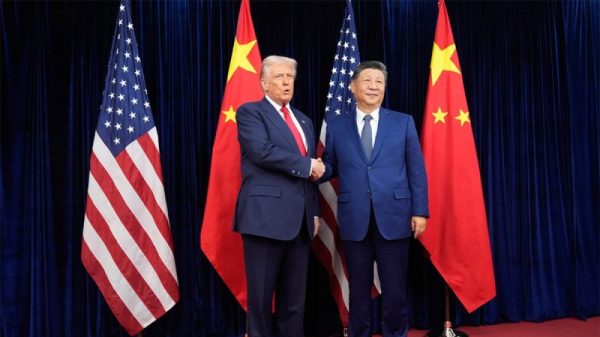

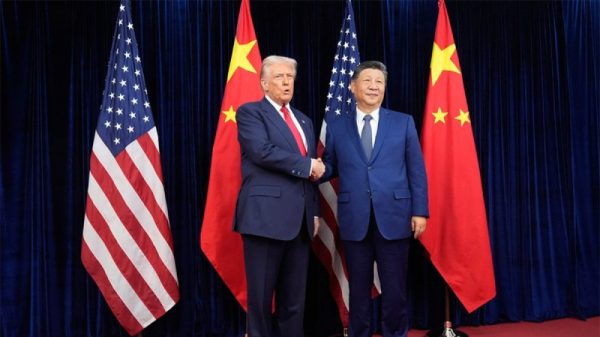

While U.S President Joe Biden arrives as a lame duck with just two months remaining in the White House, China’s President Xi Jinping will be a central player at a G20 summit riven with geopolitical tensions amid the wars in Gaza and Ukraine.

“It’s not only geopolitics that is causing us concern, but also that China’s role, its economic and financial role, is very prominent in many issues,” said a German official, who requested anonymity to discuss the diplomatic tensions freely.

While China has been in Russia’s camp on Ukraine, Germany believes Beijing will find that position harder to sustain as the conflict has become “globalised” with Russia’s deployment of North Korean troops bringing it “to China’s doorstep,” another official said.

Diplomats drafting a joint statement for the summit’s leaders have struggled to hold together a fragile agreement on how to address the escalating Ukraine war, even a vague call for peace without criticism of any participants, sources said.

A massive Russian air strike on Ukraine on Sunday shook what little consensus they had established, with European diplomats pushing to revisit previously agreed language on global conflicts.

The United States responded to the Russian attack by lifting prior limits on Ukraine’s use of U.S.-made weapons to strike deep into Russia.

Brazilian officials recognised that their agenda for the G20, focused on sustainable development, taxing the super-rich and fighting poverty and hunger could soon lose steam when Trump starts dictating new global priorities from the White House.

Brazil’s push for a reform of global governance, including multilateral financial institutions, may also hit roadblocks with Trump, Brazilian officials said.

“Trump has no appreciation for multilateralism. I don’t see many possibilities of a Trump administration engaging in these issues or showing any interest in them,” a source at Brazil’s finance ministry told Reuters on condition of anonymity.

Xi is expected to tout China’s Belt & Road initiative as it exerts its economic ascendancy. Brazil has so far declined to join the global infrastructure initiative, but hopes are high for other industrial partnerships when Xi wraps his stay in the country with a state visit in Brasilia on Wednesday.

Brazil’s decision not to join was “a big blow to relations,” said Li Xing, professor at the Guangdong Institute of International Strategies, affiliated with China’s Ministry of Foreign Affairs. “China was very disappointed,” he said.

Trade talks around the G20 will be stoked by concerns of an escalation in the U.S.-China trade war, as Trump plans to slap tariffs on imports from China and other nations.

Trump’s tax-cutting verve will add to headwinds for Brazil’s efforts to discuss taxation of the super-rich, an issue dear to Brazil’s President Luiz Inacio Lula da Silva who put it on the G20 agenda.

Trump’s newest ally in Latin America, libertarian Argentine President Javier Milei, has already drawn a red line on the issue. Argentina’s negotiators refused to approve mention of the issue in the summit’s joint communique, diplomats said.