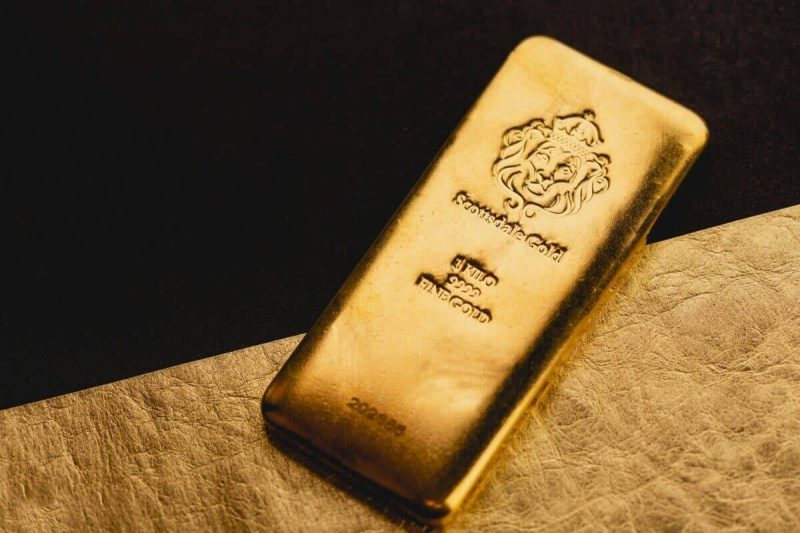

Gold Steady at $2,357.65 Amid U.S. CPI Anticipation

Quick Look:

Gold Prices Stable: Amid awaited U.S. inflation data, spot gold holds at $2,357.65/oz;

Copper Surge: Prices hit over two-year highs, fueled by Chinese stimulus expectations;

Impact of CPI Data: Crucial for future Fed rate decisions, influencing gold’s investment appeal.

In the latest trading session, gold prices showed resilience, holding steady in the Asian markets. This stability comes at a time when investors are keenly awaiting the U.S. consumer inflation data, which could significantly influence future interest rate decisions. Spot gold was recorded at $2,357.65 an ounce, with gold futures for June slightly higher at $2,361.90, showing a modest increase of 0.1%. The recent comments from Federal Reserve Chair Jerome Powell have softened the U.S. dollar, creating a favourable environment for gold. Powell’s suggestion that U.S. interest rates might have peaked reassured investors, leading to the dollar’s decline and stability in gold prices.

Global Demand and Pricing Trends for Industrial Metals

While gold maintains its steadiness, industrial metals such as copper have surged to over two-year highs. The rise in copper prices, now buoyed by the dual prospects of tightening supplies and anticipated fiscal stimulus in China, showcases a robust demand outlook in the top importing country. These factors help mitigate concerns over potential sluggishness in global demand. The anticipated Chinese stimulus is particularly significant, as it could lead to increased industrial activity and, consequently, a higher demand for copper and other base metals. This scenario presents an optimistic outlook for metal prices in the near term, aligning with China’s strategic economic expansions.

Anticipating CPI Data: Inflation and Interest Rate Implications

Financial markets are currently poised for the release of the U.S. Consumer Price Index (CPI) data for April. This anticipation comes after a producer price index (PPI) report that was higher than expected, which has heightened concerns about ongoing inflationary pressures. A “hot� CPI could deepen these worries, indicating that inflation isn’t slowing as hoped. Such a scenario would likely prevent the Federal Reserve from cutting interest rates soon. Jerome Powell recently eased some concerns about rising rates by stating that the current monetary policy is tough enough to fight inflation. However, he also warned that the Fed needs more proof of inflation approaching its 2% annual goal before considering lowering rates.

The upcoming CPI data is crucial as it will significantly influence the Fed’s policy outlook. High interest rates raise the opportunity cost of holding non-yielding assets like gold, potentially reducing its attractiveness. However, if inflation worries persist, gold could still be supported as a traditional inflation hedge. Additionally, other precious metals, such as platinum and silver, have gained value, benefiting from a weaker dollar. Both platinum and silver futures have experienced slight price increases.

The dynamics between inflation data, Federal Reserve policies, and fiscal stimuli in major economies like China will continue to be key factors that drive metal prices. Consequently, investors and market analysts will closely monitor these developments. These developments have significant implications for the global economy and investment strategies in the metals market.

The post Gold Steady at $2,357.65 Amid U.S. CPI Anticipation appeared first on FinanceBrokerage.