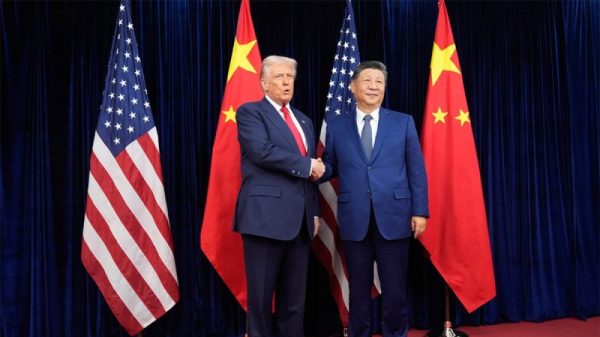

HONG KONG (Reuters) – Hong Kong will launch a new yuan-denominated trade finance scheme and expand the hours and scope of its Bond Connect program for mainland China investors, Eddie Yue, Chief Executive of the Hong Kong Monetary Authority said on Monday.

The announcement came alongside others made by China’s central bank Governor Pan Gongsheng at a business conference, including pledges to help Hong Kong provide cheap yuan funding in the territory and measures to support the yuan, which has slid to 16-month lows.

Beijing will support Hong Kong in the launch of the trade finance scheme using 100 billion yuan ($13.64 billion) in currency swaps for one, three and six months, Yue, chief of Hong Kong’s defacto central bank, told reporters on the sidelines of the Asia Financial Forum in Hong Kong.

The two central banks have a currency swap arrangement for a total 800 billion yuan.

Under the new facility, banks can exchange their Hong Kong dollars for yuan funding with the HKMA at interest rates linked to onshore rates, providing banks in Hong Kong with a stable source of relatively lower-cost yuan funds, Yue said.

Yue said the settlement deadline for the Bond Connect scheme will be extended to 4:30 p.m. (0830 GMT) and expanded to include U.S. dollar and euro-denominated bonds, besides yuan bonds.

The HKMA will also promote yuan repurchase agreements, allowing international investors to use onshore bonds as collateral for yuan funds in Hong Kong, from Feb. 10, he said.

($1 = 7.3316 Chinese yuan renminbi)