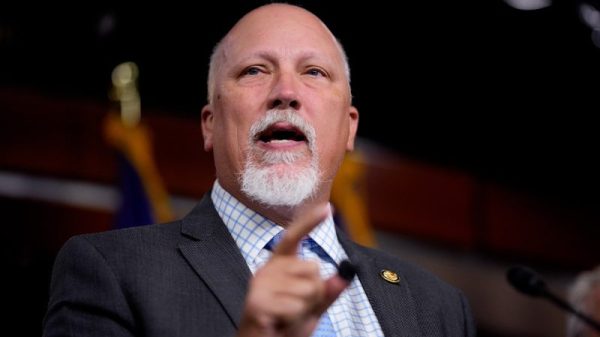

Investing.com — JPMorgan (NYSE:JPM), the largest bank in the U.S., is bullish about growth opportunities in India and Japan, while also eyeing Southeast Asia for further investments, as part of the “China Plus One” strategy, Reuters reported on Tuesday.

India remains one of the top three, possibly top two, markets in Asia, alongside Japan. The country’s growth is very broad-based, said Sjoerd Leenart, JPMorgan’s Asia Pacific CEO, in an interview to Reuters on Monday.

Leenart said that the bank’s broad commitment to India, noting that JPMorgan is increasing its investment by expanding its banking team, injecting more capital into operations, and enhancing technological capabilities to serve new market segments.

In India, JPMorgan’s commercial banking division, which serves mid-sized businesses, is projected to grow by up to 30% over the next few years, the report said.

However, he stressed that for India to fully capitalize on the “China Plus One” strategy, the country must further strengthen its manufacturing ecosystem and scale its operations.

While this presents a major opportunity, Leenart cautioned that executing this strategy could be challenging, but expressed optimism about India’s potential success.

Regarding Japan, Leenart noted that with interest rates turning positive, there is renewed client interest in the market, creating opportunities in both corporate activity and interest rate-driven investments.

Despite concerns about China’s slowing economic growth, Leenart emphasized that JPMorgan’s business in China continues to grow.

Leenart also pointed to Southeast Asia, where the combined economies amount to nearly $3 trillion, as a key region for future investment.

While the region’s fragmented nature makes it more challenging to navigate, JPMorgan remains keen to invest in the area, the report said.