Mali’s military government has approved a fresh round of mining agreements under its revised code.

The country’s Council of Ministers on Friday (September 19) ratified seven exploitation and exploration agreements, according to a Reuters report.

The deals cover some of the country’s biggest gold operations, including Allied Gold’s (NYSE:AAUC,TSX:AAUC) Sadiola project, B2Gold (TSX:BTO,NYSE:BTG) Fekola mine, Resolute Mining’s (ASX:RSG,LSE:RSG) Syama site, and Ganfeng’s (OTC Pink:GNENF,HKEX:1772) Bougouni lithium project.

The government said the agreements guarantee Mali a “non-reducible� stake in projects along with priority access to dividends, part of its drive to secure greater revenue from natural resources.

The approvals follow preliminary accords reached last year and reflect the provisions of the 2023 mining code, which lifted royalties to 10 percent from 6.5 percent and increased mandatory state and local ownership in mines to at least 35 percent from 20 percent.

Companies such as Endeavour Mining (TSX:EDV,LSE:EDV) have already signed deals on those terms, while Allied Gold, B2Gold, and Ganfeng have not release any statements.

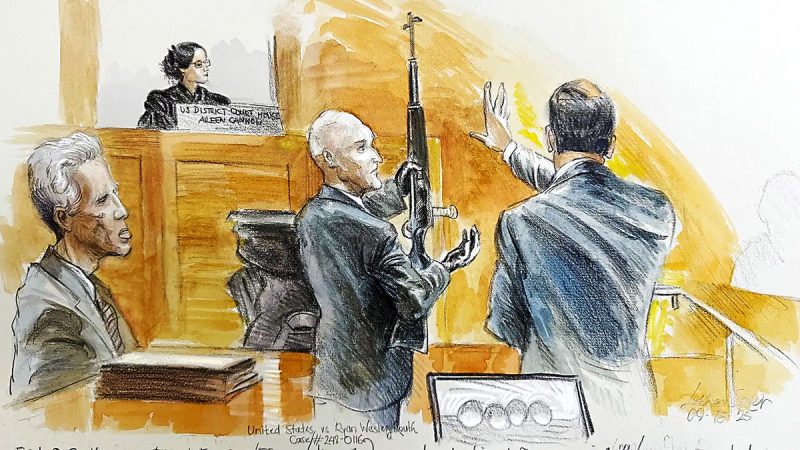

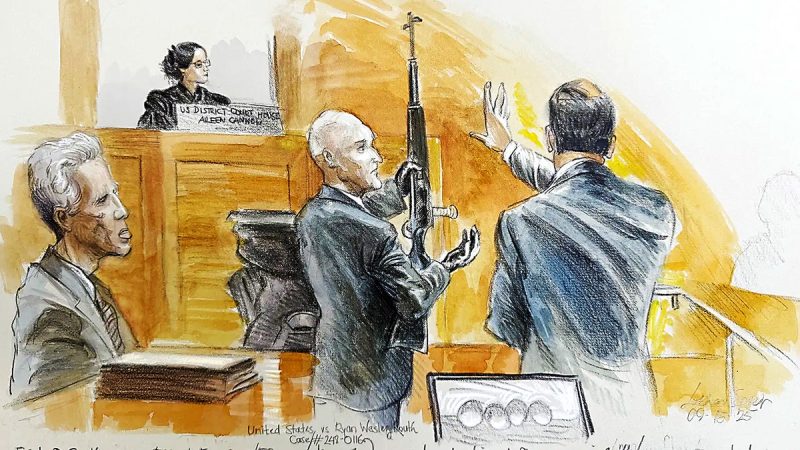

Barrick Mining (TSX:ABX,NYSE:B), by contrast, has resisted the government’s demands and remains locked in a confrontation that has now spilled into courts and international arbitration.

Tensions escalated in November 2024, when Malian authorities arrested four of the company’s employees, including a regional manager, on allegations of money laundering, terrorism financing, and tax violations.

A judge later granted bail set at 50 billion CFA francs (about US$90.3 million) but prosecutors appealed, keeping the employees in jail pending review by the Court of Appeal, Bloomberg reported.

The arrests are widely seen as part of a protracted standoff over Barrick’s Loulo-Gounkoto complex, once the company’s largest African operation.

Mali has pressed for a larger share of profits under the new mining code, while Barrick has resisted altering its existing arrangements. The dispute intensified this year when government forces twice removed bullion directly from the site.

In January, officials seized three metric tons of gold and blocked exports, forcing Barrick to suspend operations. In July, military helicopters again landed unannounced at Loulo-Gounkoto and took more than a metric ton of gold, worth over US$117 million at prevailing prices, without company consent.

Barrick has described the seizures as illegal and launched proceedings at the International Center for Settlement of Investment Disputes (ICSID). The company also disputes the legitimacy of a provisional administrator installed at Loulo-Gounkoto following a local court order in June.

Despite the tensions, Mali remains one of Africa’s top gold producers, with output from mines operated by foreign companies forming a backbone of state revenues.

Securities Disclosure: I, Giann Liguid, hold no direct investment interest in any company mentioned in this article.