Prestige Wealth Inc. (PWM) Stock Price Analysis

Is PWM stock a good buy at this moment? What is its price target and what can we expect in the following months? If you aim to invest in Prestige wealth Inc stock we bring you the latest market data.

PWM Stock Price Today: Trading Data

Prestige Wealth Inc. (PWM) ended at $0.9370 on September 3, 2024, reflecting a decline of 11.60% from the prior closing price of $1.0600.Â

In after-hours trading, there was a modest rebound, with shares increasing by 1.40% to $0.9501. The stock fluctuated between $0.9370 and $1.0600 throughout the day. Over the last year, PWM has seen prices dip to $0.6680 and peak at $7.4700.Â

Today’s trading volume reached 112,155 shares, significantly lower than the average volume of 1,005,238 shares.

Company Overview

Prestige Wealth Inc., established in 2018 and based in Hong Kong, provides wealth and asset management services primarily for high net worth clients in Asia. The company has a market capitalisation of $11.34 million but reported a financial loss with an EPS of -0.1300, lacking both trailing and forward price-to-earnings ratios.

Financial Highlights

- Profit Margin: -297.18%

- Return on Equity (ttm): -17.92%

- Return on Assets (ttm): -10.81%

- Revenue (ttm): $348.53k

- Diluted EPS (ttm): -0.1300

- Net Income Available to Common (ttm): -$1.04M

- Total Cash (mrq): $431.31k

- Total Debt/Equity (mrq): 6.16%

- Levered Free Cash Flow (ttm): -$1.24M

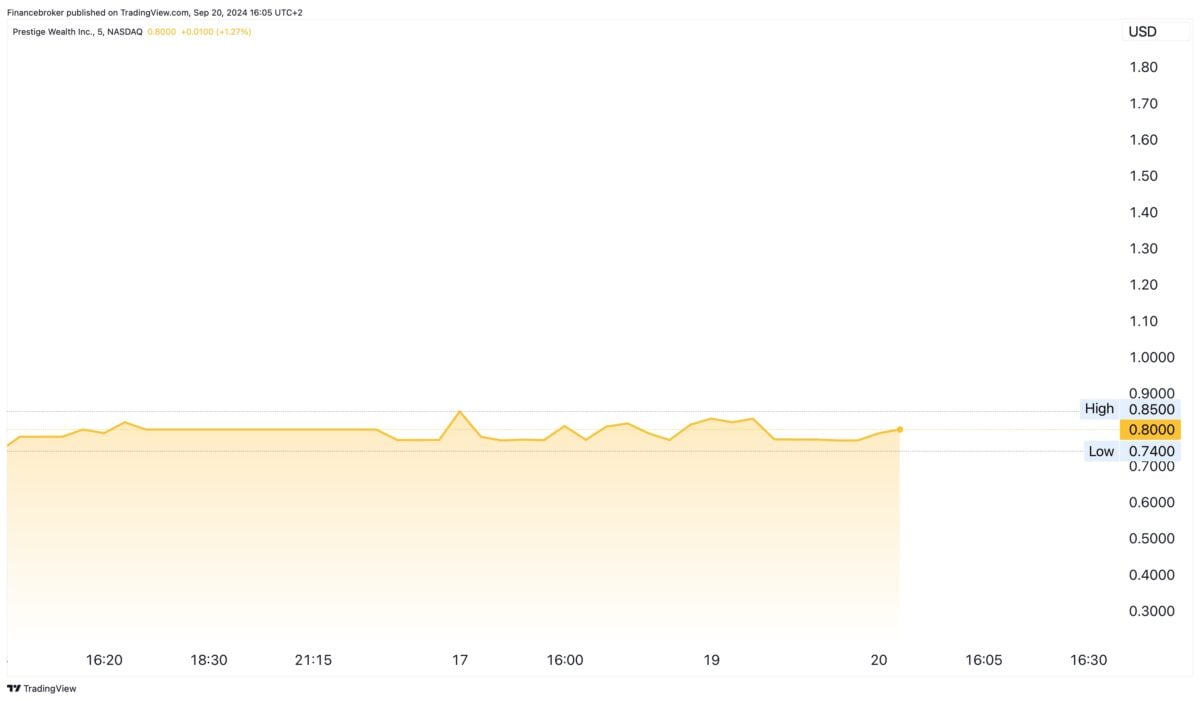

PWM/USD 5-Day Chart

What is Price forecast for PWM stock?

Our latest forecast for Prestige Wealth Inc. suggests that the share price will increase by 11.81%, reaching approximately $1.050991 per share by September 9, 2024.Â

As indicated by our technical analysis, the prevailing market sentiment is bearish, and the Fear & Greed Index currently stands at 39, indicating fear among investors.Â

Over the past 30 days, PWM stock has experienced 11 out of 30 days (37%) in the green, with a price volatility of 23.71%.Â

Given our projections, now appears to be an opportune moment to purchase PWM shares, as they are trading 10.56% below our anticipated value and may be undervalued. However, the price should decline by 1.51% tomorrow but could rebound with a 2.93% increase over the following week.

Prestige Wealth Inc. stock should reach $0.823782 in 2025, reflecting a -12.36% increase, and $0.425828 in 2030, indicating a -54.70% decline based on the current 10-year average growth rate.

Is PWM Stock a Good Buy?

The price of Prestige Wealth Inc. stock should increase by 2,132.72% in the next few years. Therefore you could consider it as a long term investment.

Prestige Wealth Inc. stock might reach $0.946026 tomorrow, reflecting a 0.64% increase. For next week, the forecast is $1.050991, indicating an 11.81% gain. Overall, the stock will rise in both the short and medium term.

Similar to any other financial asset, the fluctuations in the stock price of Prestige Wealth Inc. are primarily determined by the forces of supply and demand.Â

Various fundamental aspects, including quarterly earnings reports, product launches, mergers, and acquisitions, among other influences, can affect these forces. Additionally, market sentiment, overall economic conditions, interest and inflation rates, and political events may sway PWM’s stock price.

The post Prestige Wealth Inc. (PWM) Stock Price Analysis appeared first on FinanceBrokerage.