As Tax Day approaches, the Senate’s DOGE leader announced a new effort Monday aimed at cracking down on federal bureaucrats who have racked up billions in unpaid taxes.

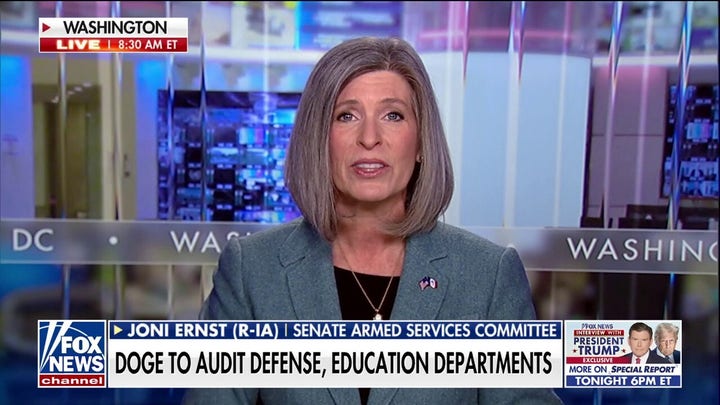

Sen. Joni Ernst, R-Iowa, is introducing the Tax Delinquencies and Overdue Debts are Government Employees’ Responsibility (Tax DODGER) Act in response to reports of tax scofflaws within the bureaucracy the taxes themselves are supposed to bankroll.

The Tax DODGER Act would require the Internal Revenue Service (IRS) to publish an annual report on tax delinquencies of current and retired federal employees, including those who failed to file a 1040 or other tax return.

‘It is outrageous that while hardworking Americans fork over their money to Uncle Sam, nearly 150,000 bureaucrats refuse to pay their own taxes,’ Ernst told Fox News Digital.

The bill also establishes a new section in the law that could consider a federal job applicant ineligible for hire if they have ‘seriously delinquent’ tax debt, unless already granted a hardship exemption.

‘If you don’t pay taxes, you should not work for the federal government,’ Ernst said.

‘I am ending the ‘rules for thee, but not for me’ mentality in Washington.’

Ernst highlighted a recent Treasury Inspector General report showing that while 96% of IRS employees were found to be tax-compliant, more than 2,000 employees had past-due balances totaling more than $12 million as of the end of last year.

Meanwhile, a 2023 IRS report found 149,000 total federal employees owed $1.5 billion in tax liabilities for fiscal year 2021.

She wrote to Treasury Secretary Scott Bessent in March that Americans and many lawmakers had ‘lost confidence in the IRS’ and that he had an opportunity as the agency’s new ultimate boss to address several issues that don’t need congressional approval.

The lawmaker referenced past political weaponization of the agency – such as when Obama-era staffer Lois Lerner allegedly targeted conservative groups – as well as upgrading the IRS’ reportedly outdated technology.

As part of her initial effort last fall to forge a working relationship with DOGE leader Elon Musk, Ernst similarly launched a call for an audit of the IRS.

If passed, the bill would require that reports on tax-scofflaw bureaucrats be sent on an annual basis to the Office of Personnel Management, Senate Homeland Security and Government Affairs Committee, and House Oversight Committee.

Additionally, any agency leader may take personnel action up to and including the firing of a federal employee if there is administrative or judicial determination they understated their tax liability or failed to file a return.