By Hannah Lang and Chris Prentice

WASHINGTON (Reuters) – Top Republican officials at the U.S. Securities and Exchange Commission are poised to begin overhauling the agency’s cryptocurrency policies potentially as early as next week when President-elect Donald Trump takes power, said three people briefed on the matter. Among the measures commissioners Hester Peirce and Mark Uyeda are weighing are initiating the process that would ultimately lead to guidance or rules clarifying when the agency considers a cryptocurrency to be a security, and reviewing some crypto enforcement cases pending in the courts, two of the people said. Paul Atkins, Trump’s crypto-friendly pick for SEC chair and former agency commissioner, is widely expected to end a crypto crackdown led by President Biden’s Democratic SEC chair Gary Gensler, but it is unclear when the Senate will confirm him.

Gensler has said he will step down on Jan. 20 when Trump is sworn in.

As of next week, Peirce and Uyeda will hold the majority among the agency’s politically-appointed commissioners and are poised to get the ball rolling in the interim, the people said.

Like Atkins, the pair are crypto enthusiasts who have criticized Gensler’s tough stance on the industry and have in the past floated alternative crypto-friendly initiatives. Peirce and Uyeda were aides to Atkins when he was at the SEC from 2002 to 2008 and the three have a good relationship, according to one of the sources and several other former SEC officials. The three have discussed potential crypto policy changes, said the sources who declined to be identified discussing private policy plans.

Peirce, Atkins and their representatives did not respond to requests for comment. A spokesperson for Uyeda did not respond to a request for comment. Worried about fraud and market manipulation, Gensler’s SEC brought at least 83 crypto-related enforcement actions, suing multiple prominent companies like Coinbase (NASDAQ:COIN) and Kraken, agency data shows. In many cases, the SEC argued crypto tokens behave like securities and that the companies and their products should comply with SEC rules, although some allege fraud. In the first few days of the new administration, the SEC is expected to begin a review of those court cases and potentially freeze some litigation that does not involve allegations of fraud, said two of the sources. Some of those cases could eventually be withdrawn. Many of those defendants argue cryptocurrencies are more like commodities than securities and that it is not clear when SEC rules apply. They have called for the SEC to write new regulations which would clarify when a token is a security. Peirce and Uyeda are expected to kick off the early stages of that rule-writing process, likely with a call for industry and public feedback, the two sources said.

Reuters and others have previously reported that the SEC is also likely to quickly rescind accounting guidance that has made it prohibitively costly for some listed companies to hold crypto tokens on behalf of third parties.

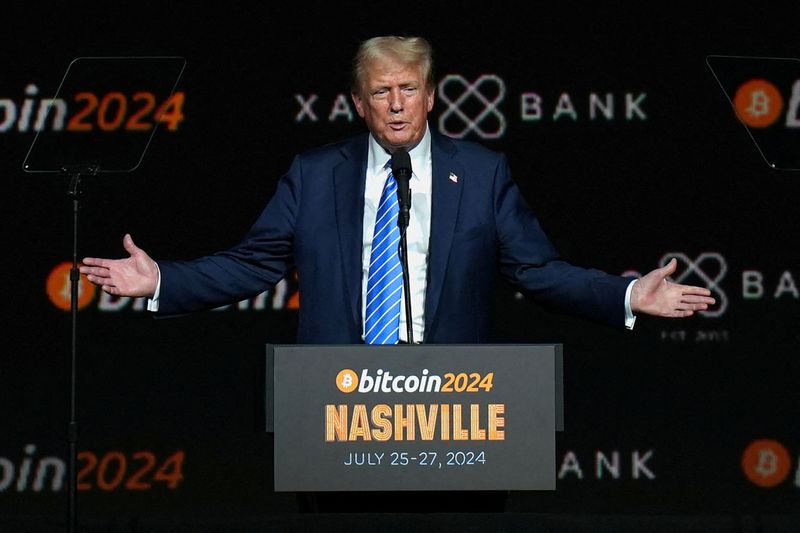

Trump, who courted crypto campaign cash with pledges to be a “crypto president,” is also expected to issue executive orders urging regulators to review their crypto policies, Reuters reported. Bitcoin soared past $100,000 for the first time in December on excitement over the new crypto-friendly administration.

‘HELD ACCOUNTABLE’ Still, even with a head start, reaching an agreement on crypto regulations could take months or longer, as could resolving complex enforcement actions that hinge on the definition of a security. Dismissing dozens of enforcement actions would be unprecedented, and could set a risky precedent by politicizing the enforcement process, said Philip Moustakis, partner at Seward & Kissel and former SEC attorney. In some cases, the court may object, said other lawyers.

One option for the agency would be to re-open settlement negotiations, said Robert Cohen, a partner at Davis Polk who previously worked in the SEC’s enforcement division. Settlement talks, aimed at averting lengthy and public litigation, are the norm, but crypto companies say the SEC under Gensler has been unwilling to engage in substantive discussions. Cohen added the new SEC leadership would likely continue to take a tough line on crypto fraud. “I think the industry wants to see fraudsters or wrongdoers held accountable,” he added.

(Additional reporting and writing by Michelle Price; Editing by Nick Zieminski)