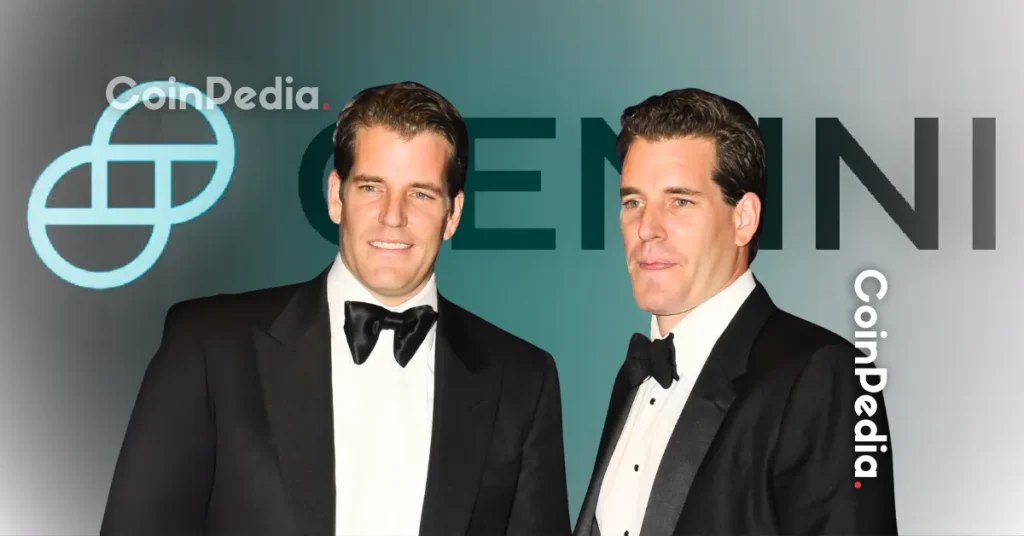

The post Winklevoss Twins Backed Gemini Eyes Prediction Markets As Competition Heats Up appeared first on Coinpedia Fintech News

Gemini, the crypto exchange started by the Winklevoss twins, is taking bold steps to diversify its business as its stock struggles after going public.

With prediction markets gaining major attention and big players joining in, Gemini is also getting ready to enter this fast-growing space, hoping to move beyond crypto and reach a wider audience.

Gemini Eyes Prediction Markets

According to a report from Bloomberg, Gemini is planning to introduce prediction market contracts. This move would place Gemini among a growing number of financial companies that are exploring prediction markets.

Prediction markets are platforms that allow people to trade on the outcomes of real-world events like elections, sports games, and economic trends. The exchange aims to launch the new products as soon as possible.

Approval Could Face Delays

Gemini filed for regulatory approval back in May to launch its own derivatives exchange, known as a designated contract market. The company hopes to use this platform to trade prediction contracts once it’s approved. The application is currently under review.

Notably, getting approval from the US Commodity Futures Trading Commission (CFTC) can take months or even years. Moreover, the recent government shutdown has slowed down many federal agencies, which could further delay the process.

Gemini Faces Rising Competition

Other exchanges and retail investment brokers have teamed up with existing prediction market operators that already have the licenses. For example, Robinhood lets its users trade event contracts through Kalshi.

However, Gemini’s plans could put it in direct competition with big names like Kalshi and Polymarket. Kalshi is already regulated by the US derivatives watchdog, while Polymarket is preparing to reopen for US users soon. Kalshi and Polymarket hit record trading volumes in October.

Big Names Join the Race for Prediction Markets

Major financial exchanges like Intercontinental Exchange Inc. and CME Group Inc. are also stepping up into this space. Gemini’s biggest US crypto rival, Coinbase also shared plans to offer event contracts as well.

Moreover, Trump Media and Technology Group, the company behind Truth Social, is also moving into prediction markets through a new partnership with Crypto.com.

Prediction Markets Offer Hope Amid Stock Slide

However, Gemini’s stock has dropped sharply since its IPO, down more than 40% from its debut price. At the time, it had announced plans to launch event contracts linked to economics, finance, politics, and sports.

The company will release its first earnings report as a public firm on November 10, and is still operating at a loss. Gemini accounts for only a small portion of overall crypto trading activity in the U.S.

Analysts note that prediction markets could help Gemini expand beyond its current offerings. As regulators become more pro-crypto, the CFTC has also eased its tough stance on prediction markets However, they still face a lot of regulatory uncertainty.

While the CFTC has approved Kalshi to launch new markets, state gaming regulators have challenged the move in court.

Gemini’s move into prediction markets could be a big step in reshaping its business, which could help it grow beyond regular crypto trading.