“McCormick’s promised the richest people in America a massive tax break. To pay for it, he’s made clear he’ll slash your Medicare and Social Security and cut Medicaid for nursing home care.�

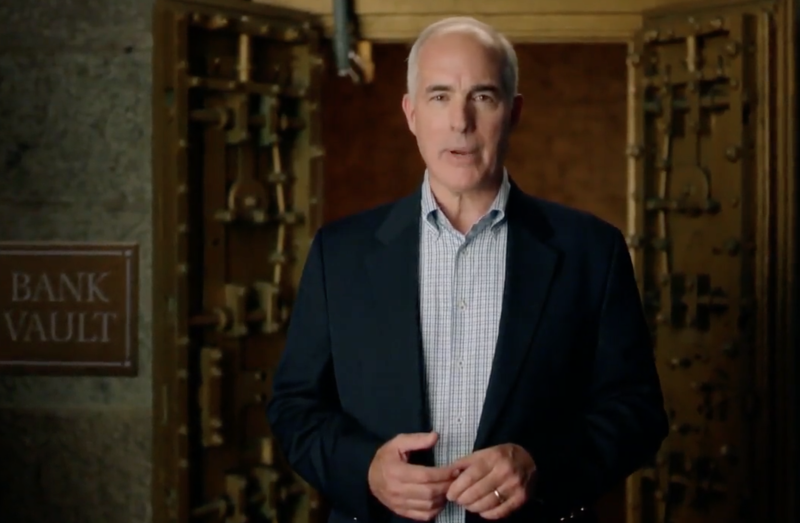

— Sen. Bob Casey (D-Pa.), speaking to the camera in a new ad, released Oct. 10

The Senate race between Casey, the incumbent, and former hedge fund manager Dave McCormick is one of the closest in the nation and could determine control of the chamber. In this ad, Casey walks out of a bank vault as he complains that McCormick’s “billionaire buddies� have spent $150 million attacking him.

Then he does something unusual — he directly attacks McCormick as having “made clear he’ll slash your Medicare and Social Security and cut Medicaid for nursing home care.� Usually, negative ads use voice-overs or text to make incendiary claims, as a way to shield the candidate from possible fact checks.

When Casey utters this line, the ad shows images of elderly people, and the small text citation reads “Americans for Tax Fairness, March 3, 2023.� Our antenna went up. The Fact Checker has covered budget and tax policy in Washington for more than three decades and had never heard of this group. Moreover, McCormick officially announced he was running for the Senate on Sept. 21, 2023 — so how would a report from six months earlier be relevant?

It turns out this accusation was made up.

The Facts

Americans for Tax Fairness, on its website, describes itself as a “diverse campaign of more than 420 national, state and local endorsing organizations united in support of a fair tax system that works for all Americans.� The staff have links to labor and other liberal organizations. But the tip-off that this is no ordinary think tank or research organization is that it says it is a project of the New Venture Fund — which is a liberal dark money group, meaning it disguises the source of its contributions. New Venture’s most recent tax filing indicates it has more than $1 billion in assets.

The group has an affiliate, Americans for Tax Fairness Action Fund, funded by an entity connected to New Venture called Sixteen Thirty Fund. Because it’s listed under a different section of the tax code, the action fund can do more overt political activity. But the fruits of the main organization still can end up being cited in campaign ads such as this one.

Americans for Tax Fairness issues reports with some detailed analysis, but that citation in the ad was to a March 2023 “fact sheet� titled “Renewing The Trump Tax Cuts Benefits The Rich & Threatens Social Security, Medicare, Medicaid & More.�

The across-the-board tax cut that Congress approved in 2017 will expire at the end of 2025, which will pose a challenge for the next president and Congress. Former president Donald Trump wants to renew the tax cut and has proposed other tax breaks. Vice President Kamala Harris proposes to keep the tax cuts in place for people making less than $400,000 but end them for wealthier Americans — and also boost taxes on the super-rich. As we’ve noted before, under the 2017 law, most taxpayers received a tax cut, but the wealthy got a larger share because they pay more in taxes.

Casey’s staff directed us to a line of the fact sheet to justify the accusation that McCormick has “made clear� he would cut entitlement programs to pay for extending the tax cuts: “Renewing the costly Trump tax cuts will explode the deficit, thereby threatening funding for Social Security, health care (including Medicare and Medicaid), education, nutrition programs, child care and other public services vital to working families.� The fact sheet said that “this explosion in debt would be used by Republicans as an excuse to significantly cut Social Security, health care (including Medicare and Medicaid)� and other programs.

But this is a prediction — not a factual statement. Both Trump and Harris’s plans are projected to increase the federal budget deficit, according to the Committee for a Responsible Federal Budget. Trump’s deficits ($7.5 trillion over 10 years) would be more than double Harris’s ($3.5 trillion). How Congress would grapple with the shortfalls — or if it would — is unclear.

The Casey campaign also pointed to comments that McCormick — a former senior Treasury Department official — made in 2022. Speaking at a meet-and-greet, McCormick noted that “we made promises� to “anybody in this room that’s got gray hair.� But he said, “as a matter of reality,� entitlements “aren’t sustainable in their current form for the future of our country.�

“I don’t think my kids are going to be able to live under the same entitlements [as] all of us that are here,� McCormick said. “We have to face that reality and do two things at the same time: keep our promises to people we made them to, and change our entitlements in a way that are defensible and fundable into the future.�

To some extent, this is an unremarkable statement. Since 1995, the trustees of Social Security have warned, year after year, that a financing crunch would occur early in the 2030s, resulting in an immediate cut in benefits, unless Congress took action to address the problem. There’s less than 10 years to go, but the two parties have been at an impasse. (Medicare faces similar financing challenges with a similar time frame.)

As a fix, Democrats have favored raising payroll taxes or raising the income level subject to tax. Republicans have preferred raising the retirement age from 67 or changing the rate at which Social Security benefits are adjusted for inflation. For Republicans, higher taxes are a non-starter. For Democrats, a higher retirement age is unfair to workers who earn money through manual labor.

Trump, we should note, has ruled out any changes to Social Security. If he’s elected to a second term, the financing crisis probably will be deferred — something for the president elected in 2028 to deal with.

The Casey campaign also pointed to the fact that, as a Bush administration official, McCormick supported George W. Bush’s plan to add private accounts to Social Security. That plan was swiftly rejected by a Republican-controlled Congress nearly two decades ago. Republicans haven’t suggested the idea again.

Asked for comment, the McCormick campaign directed us to remarks he made at an event in June: “We need to support our seniors in retirement. Let me be perfectly clear: Our government needs to keep its promises to protect Social Security and Medicare.�

This line is in keeping with his statement in 2022 — that some adjustments in benefits might be necessary for younger workers, but current benefits would be kept for people at or near retirement. That’s far different from “slash your Medicare and Social Security.�

The Pinocchio Test

It’s a bold move for a campaign to have the candidate practically put words in the mouth of his opponent. Usually, when a candidate speaks in an ad, the claims he or she makes are factually grounded.

Casey claims that McCormick, in backing an extension of the Trump tax cut, “made clear he’ll slash your Medicare and Social Security and cut Medicaid for nursing home care.� McCormick has said no such thing. Rather he’s acknowledged financing challenges that are discussed in government reports.

One could question whether adding to the budget deficit is a wise move in the face of the fiscal challenges. But that’s not what Casey is doing. He’s falsely accusing McCormick of espousing a deliberate plan to cut benefits for seniors. He earns Four Pinocchios.

Four Pinocchios

(About our rating scale)

Send us facts to check by filling out this form

Sign up for The Fact Checker weekly newsletter

The Fact Checker is a verified signatory to the International Fact-Checking Network code of principles